- Boeing 777x Emirates Seat Map

- Emirates Cancel 777x

- Boeing 777 Emirates Seat Map

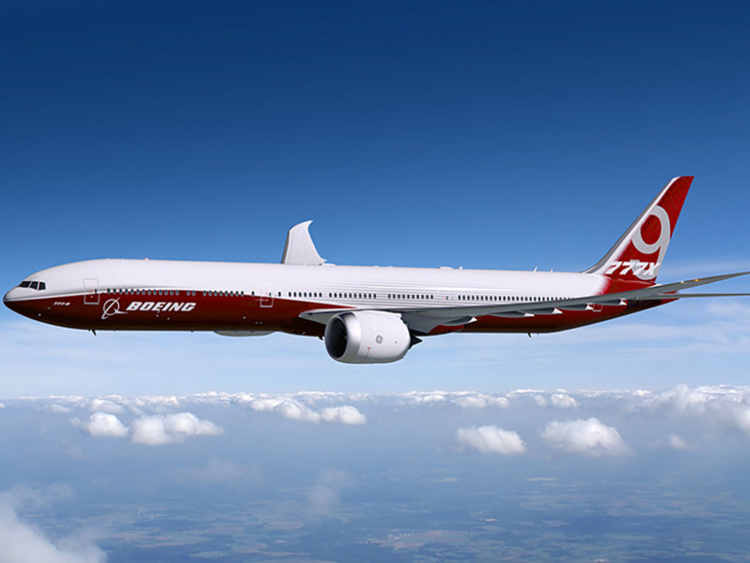

- Boeing 777x Pictures

- Boeing 777x Emirates Jet

- Boeing 777x Emirates International

When Emirates first announced its record-breaking order in 2013 for 150 Boeing 777X aircraft – the future was incredibly bright. Both Emirates and Boeing were growing at an incredible rate, and there was no reason to suspect anything would change. Boeing 777 and 777X. Emirates has the world's largest fleet of Boeing 777s, and plans to start phasing out older 'classic' 777s in favour of new 777Xs. In October 2014, Emirates retired its first Boeing 777 after 18 years of service, and the same month took delivery of its 100th Boeing 777-300ER. Emirates is reconsidering its commitment to Boeing’s newest jet, the 777X.The Dubai-based carrier is considering swapping as much as one-third of its order of the 777X for the smaller Boeing 787 Dreamliner, according to a person familiar with the matter. 2 days ago The Boeing 777X airplane. Gulf carrier Emirates is said to be seeking to switch between 30 and 40 of its 115 commitments for the 777X to the Dreamliner as it calibrates fleet plans. Text Size: A A A. Bloomberg/ Dubai.

(Bloomberg) -- Boeing Co.’s new 777X jet is likely to miss its planned debut next year, according to the aircraft’s top customer Emirates, which doesn’t expect to receive any planes before 2022.

Deliveries of the wide-body jet, which first flew in January, will probably be held up by Boeing’s shutdown at the height of the coronavirus pandemic, together with a lengthy certification process, Adel Al Redha, the Gulf carrier’s chief operating officer, said Thursday in an interview.

Emirates is also considering whether to seek a swap of some of the 115 777Xs it has on order -- representing more than a third of the total backlog -- for the smaller 787 Dreamliner, which might be better matched to demand, he said. Accelerating deliveries from an earlier Dreamliner order is a “possibility,” he said.

© Bloomberg Boeing 777X Takes First Flight Into Troubled Skies for JumbosPilots exit a Boeing 777X airplane after a test flight in Seattle, Washington.

Boeing 777x Emirates Seat Map

Popular Searches

Photographer: Chona Kasinger/Bloomberg

“We will be discussing with Boeing in that regard, if we look what we can do with the 787,” Al Redha said. “We are in a fluid discussion and in the peak of re-examining all these kind of things. It does require re-examination, it does require re-thinking, it does require renegotiation.”

Other buyers are also resisting taking delivery of such a large plane when they’re being compelled to shrink operations, according to people familiar with the matter. Boeing is looking at delaying the upgraded 777’s introduction, said the people, who asked not to be named discussing confidential matters. The company’s first new-jet introduction since the grounding of its 737 Max after two fatal crashes also faces increased scrutiny from the U.S. Federal Aviation Administration and other regulators.

“I don’t see that they will be able to deliver the aircraft in 2021,” Al Redha said. “We will engage with Boeing to get more visibility. I think 2022 is a safe assumption to make.”

Making Progress

Boeing said it’s working closely with its customers to adapt to the evolving Covid-19 situation. The Chicago-based company also said that it would soon add a third aircraft to its flight-testing program.

“We continue to execute our robust test program for the 777-9, which began flight testing in January,” Boeing said in a statement, referring to the longest version of the 777X. “We remain pleased with the progress we are making and with the airplane.”

Boeing fell 3.8% to $173.28 Thursday in New York. The shares have fallen 47% this year, the biggest drop on the Dow Jones Industrial Average.

The FAA said it can’t comment on its efforts to review the manufacturer’s work to upgrade the 777.

While the agency is taking steps to make risk assessments more rigorous in the wake of the Max grounding, the certification process for the 777X began before the crashes and shouldn’t be affected by the reforms. All the same, the spotlight on the process could trigger other actions that slow down approval.

The timing of the 777X commercial debut has been at the heart of complex negotiations with Emirates, which has already converted some of its original order for the smaller and more versatile Dreamliner. The first delivery for the 777X was originally set for this year, though the date was pushed back to 2021 following issues including delays to the plane’s General Electric Co. turbines.

While Emirates’ 2013 order was instrumental in Boeing’s decision to go forward with the 777X, it isn’t clear if the airline or another of the launch group of customers would take the initial delivery.

Cash Source

By potentially accelerating its 787 deliveries, Emirates would help support a critical cash source for Boeing amid an uncertain market for wide-body aircraft. The planemaker has outlined plans to halve Dreamliner production as the Covid-19 pandemic spreads, citing fading demand for near-term deliveries.

Chicago-based Boeing will also be eager to begin handovers of the 777X after the Max crisis deprived it of revenue from its best-selling program. But the twin-aisle model, which boasts bigger wings and new engines, is arriving at a time when the high-volume long-haul market it’s designed to serve may be depressed for years.

The 777-9 variant is longer than the 747 jumbo Boeing is winding down, and is the first twin-engine jet able to carry a similar number of people. It’s also the company’s priciest model, selling for $442.2 million before customary discounts.

Sales, though, have stalled since an initial order flurry when the aircraft was unveiled at the 2013 Dubai Airshow, and anticipated orders from China haven’t materialized amid trade tensions.

For the U.S. planemaker, there’s a risk that additional order conversions and deferrals will leave it manufacturing the jet in such low quantities that 777X profitability would be hurt. Qatar Airways, Cathay Pacific Airways Ltd. and Deutsche Lufthansa AG are among customers that are restructuring their fleet plans.

Long-Haul Slump

Emirates, the world’s largest long-haul airline, has been hard hit by the unprecedented slump in travel caused by the coronavirus. It’s already had to rethink plans for the double-decker A380, a mainstay of its all wide-body fleet, after a dearth of demand elsewhere led Airbus SE to decline to upgrade the jet and then to terminate the program early.

The Gulf carrier, also the biggest customer for the Airbus super-jumbo, plans to take delivery of three A380s during the fiscal year ending in March, Al Redha said. While the delivery schedule for the last five planes remains unchanged, “if the need comes to re-visit, obviously we will do that.”

Read more:

He said he expects 60% to 70% of the current A380 fleet to be back in the air by December. Load factor now exceeds 55% and demand for both economy and premium travelers has strengthened, he said. The airline plans to keep all 115 of the double-decker jets.

The Dubai-based carrier will roll out premium economy seats on its newest A380 aircraft slated to be delivered in November, Al Redha said. Some of the existing fleet will be retrofitted from economy to premium economy.

Two Brands

Emirates Group is also looking for ways to streamline operations and increase efficiencies, Al Redha said. One of the possibilities that is being considered is combining the back office operations of Emirates with discounter Flydubai, while maintaining two separate companies and identities. Both carriers are owned by Dubai’s government.

“There is definitely a scope having to look at how we can reduce the expenses and become more efficient in certain areas, even if requires combining some back office activities,” Al Redha said. Emirates is re-examining all companies within the group, including ground-handling and catering arm Dnata.

Emirates and Flydubai have deepened their ties since 2017, embracing route rationalization to minimize duplication.

(Updates headline, share price)

For more articles like this, please visit us at bloomberg.com

©2020 Bloomberg L.P.

© Provided by The Points GuyEmirates is reconsidering its commitment to Boeing’s newest jet, the 777X. The Dubai-based carrier is considering swapping as much as one-third of its order of the 777X for the smaller Boeing 787 Dreamliner, according to a person familiar with the matter.

Popular Searches

As first reported by Bloomberg, Emirates is looking to swap between 30 and 45 of its 115 777X orders for Dreamliners. The move would be a troubling one for Boeing and its 777X program, as Emirates is the largest customer of the yet-to-be-launched aircraft.

Emirates’ move isn’t the first of its kind. Boeing indicated on Monday that it’s at risk of losing nearly 40% of its 777X orders because of delays. With the 777X now slated to debut in 2023 — more than two years later than previously expected — customers are permitted to walk away from their contracts.

Related:All about the new Boeing 777X

This week, Boeing lowered the backlog of the 777X to just 191 aircraft, according to a regulatory filing. That number, much lower than the 309 firm orders that are listed on the planemaker’s site. Boeing said in an email that the drop is the result of an accounting standard that requires sales at risk of not happening to be removed from the backlog.

In its fourth-quarter earnings call, Boeing detailed that it had taken a $6.5 billion charge for delays to the 777X. The delay could bring additional losses to Boeing when it considers cancellations, production cuts and flight-testing risks.

Emirates, which was one of the first 777X customers, declined to comment on the report that it’s looking to drop some of its 777X order in favor of the 787 Dreamliner.

As the coronavirus pandemic continues to set back the aviation industry, airlines have largely set aside their long-haul routes. As such, the demand for wide-body, twin-aisle planes has decreased — including for the future of the 777X, which is set to be the heir to the superjumbo Boeing 747. Orders for wide-body aircraft with both Boeing and Airbus are expected to be the last to recover from the pandemic-spurred drop in demand. Boeing has already said that it’s cut the output of its Dreamliners.

“The decline in backlog in the fourth quarter reflected aircraft order cancellations and removal of aircraft orders from our backlog due to the ASC 606 accounting standard, including our most recent assessment of 777X backlog due to the revised schedule,” Boeing Chief Financial Officer Greg Smith said on a call with analysts last month.

Boeing saw a similar slump in orders for the 737 MAX aircraft following its nearly two-year worldwide grounding. More than 1,100 orders for the plane were removed from Boeing’s backlog of the 737 Max.

Emirates Cancel 777x

Boeing 777 Emirates Seat Map

Related:Boeing’s bad quarter: Company delays 777X, 737 MAX timeline as COVID hits business

In its fourth-quarter earnings report, Boeing posted a record net loss of nearly $12 billion. The two-pronged dagger to Boeing consisted of the ongoing effects of the beleaguered 737 MAX, as well as the COVID-19-spurred downturn in demand.

“I’m sure glad 2020 is in the rearview mirror,” Boeing CEO Dave Calhoun told CNBC.

Boeing 777x Pictures

Featured photo by Zach Wichter/The Points Guy

Boeing 777x Emirates Jet

SPONSORED: With states reopening, enjoying a meal from a restaurant no longer just means curbside pickup.

And when you do spend on dining, you should use a credit card that will maximize your rewards and potentially even score special discounts. Thanks to temporary card bonuses and changes due to coronavirus, you may even be able to score a meal at your favorite restaurant for free.

These are the best credit cards for dining out, taking out, and ordering in to maximize every meal purchase.

Boeing 777x Emirates International

--

Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.